Services of the Uzum ecosystem lead the rankings in the first-ever study of digital habits and preferences of Uzbekistan’s population. The study conducted by Research Group Central Asia (RGCA), an IPSOS-accredited research agency, surveyed participants aged between 18 and 54 sampled to accurately represent the country’s demographics. Over 50% of Uzbekistan’s population of 35 million are young people actively using digital services. The respondents gave unaided answers on product preferences to reveal the most popular platforms.

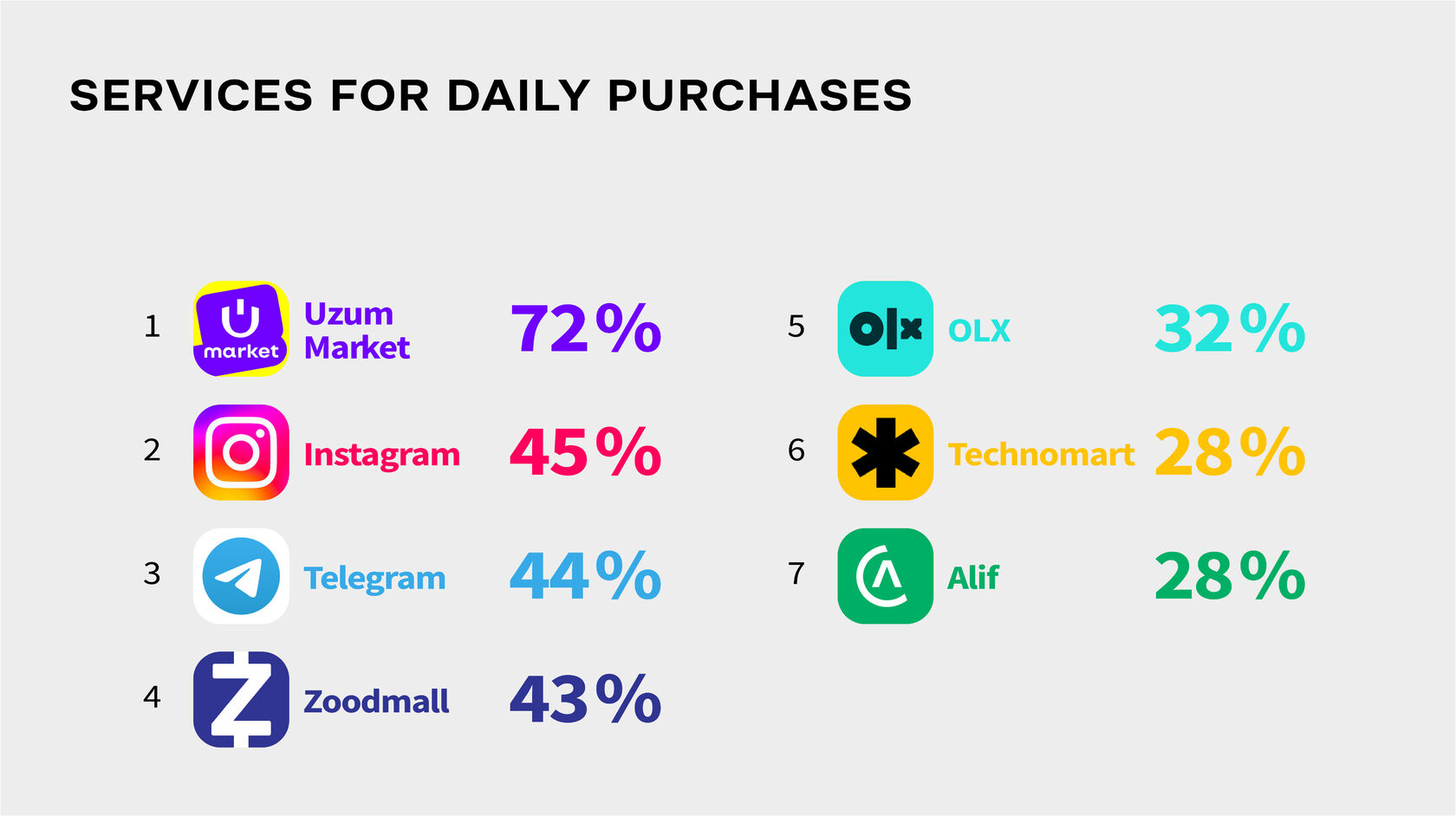

According to the survey, Uzum Market took first place among the services for daily purchases with ¾ of respondents (72%) naming the marketplace as their go-to e-commerce destination. The other two platforms were Instagram (45%) and Telegram (44%). In less than a year Uzum Market, a leading online marketplace providing access to over 500,000 SKUs with a single-day delivery across the country, acquired millions of users and topped the apps ranking in mobile stores.

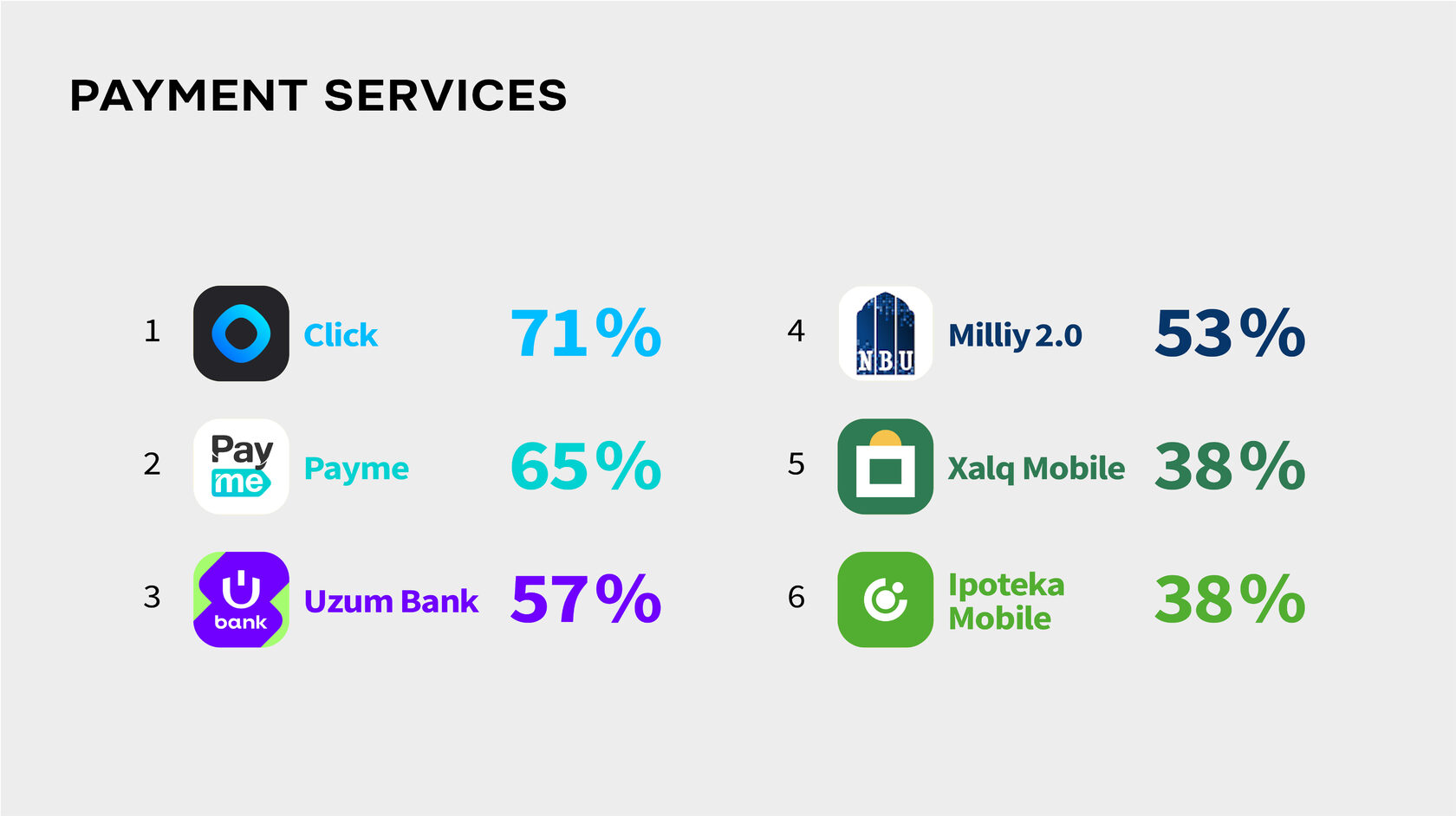

Among the payment services, the national payment system Click came out as an absolute leader in the answers of 71% of respondents, while the second and third places went to Payme (65%) and Uzum Bank (57%) respectively. The recently announced plans of Click to merge with Uzum ecosystem would allow offering advanced fintech services to more than 13 million people, over a third of the country’s population, and launch new products aimed at a wider range of daily needs.

With this study we aimed to reflect how the daily lives of people of Uzbekistan changed with the onset of the digital economy. We see how digital services are replacing and supplementing traditional outdoor markets and bank branches, and such a detailed survey allows us to understand what services address the needs of the local users best and reveal the leaders in convenience and brand awareness.

We are seeing tremendous interest in the services of the Uzum ecosystem. Since the launch of Uzum Market over 6000 merchants from across the country registered on our platform. Moreover, every month more than 500 businesses partner with our Shari’ah compliant BNPL installments service Uzum Nasiya. Synergy of services within the ecosystem creates unique opportunities that drive the process of businesses and customers transitioning from offline to online. The young and entrepreneurial population of Uzbekistan is actively exploring these new services both for day-to-day use and business growth.